The clock is ticking! With the tax filing deadline for 2023 approaching on April 15, 2024, there’s still time to maximize your retirement savings with an Individual Retirement Account (IRA). This article explains everything you need to know about contributing to an IRA for 2023, including different account types, contribution limits, tax benefits, and how to squeeze in a contribution before the deadline.

Here’s a comprehensive guide to help you make the most of the 2023 IRA deadline:

1. Understand the Contribution Limits

- You can contribute up to $6,500 to an IRA for 2023, or $7,500 if you’re 50 or older by December 31st, 2023.

- Total contributions across all your IRAs cannot exceed this limit or 100% of your taxable compensation, whichever is less.

- You can also contribute for your spouse, even if they had no earned income in 2023.

2. Choose the Right IRA Type

- Traditional IRA: Contributions may be tax-deductible, depending on your income and work-based retirement plan coverage. Distributions in retirement are taxed as income.

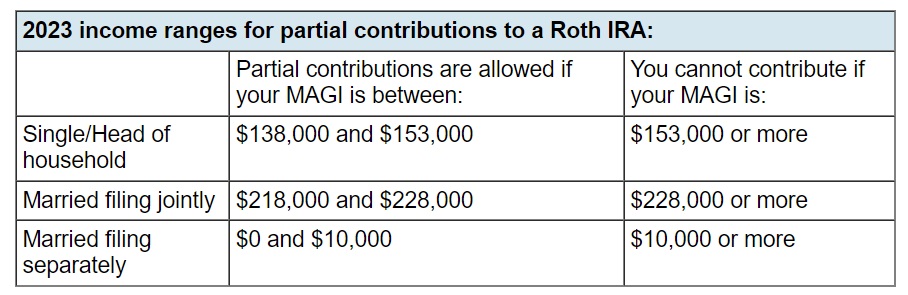

- Roth IRA: Contributions are not tax-deductible, but qualified distributions are tax-free in retirement.

3. Maximize Your Tax Benefits

- Traditional IRA: If you weren’t covered by a work-based plan in 2023, your contributions are fully deductible. If you were partially covered, your deduction might be limited based on your income.

- Roth IRA: If you’re ineligible for a full traditional IRA deduction, consider a Roth IRA. Even though contributions aren’t tax-deductible, tax-free distributions in retirement can be a significant advantage.

4. Don’t Miss Out on Roth IRA Options

- Even if you exceed the income limits for direct Roth IRA contributions, you can still benefit with a “backdoor Roth IRA” strategy. This involves making a nondeductible contribution to a traditional IRA and then converting it to a Roth IRA. Consult a tax advisor to ensure this strategy aligns with your financial situation.

5. Act Before the Deadline

- You have until April 15th, 2024, to fund your IRA for 2023. Don’t wait until the last minute to take advantage of this valuable opportunity.

Additional Tips

- Start early: Contributing consistently throughout the year can help you reach your retirement goals faster.

- Seek professional advice: A financial advisor can help you determine the best IRA type and contribution strategy for your individual circumstances.

- Consider your long-term goals: Remember, your IRA is for retirement savings. Choose investment options that align with your risk tolerance and retirement timeline.

By understanding the different IRA options and taking action before the deadline, you can maximize your retirement savings and potentially reduce your tax burden. Don’t miss out on this chance to secure your financial future!

JS Morlu LLC is a top-tier accounting firm based in Woodbridge, Virginia, with a team of highly experienced and qualified CPAs and business advisors. We are dedicated to providing comprehensive accounting, tax, and business advisory services to clients throughout the Washington, D.C. Metro Area and the surrounding regions. With over a decade of experience, we have cultivated a deep understanding of our clients’ needs and aspirations. We recognize that our clients seek more than just value-added accounting services; they seek a trusted partner who can guide them towards achieving their business goals and personal financial well-being.

Talk to us || What our clients says about us