By: John S. Morlu II, CPA

If you’ve ever texted your ex at 2 a.m., tried to toast bread in a microwave, or invested in something just because a guy in sunglasses said “to the moon”—relax. At least you didn’t vaporize a billion dollars in the process.

Some of the biggest companies on Earth have made decisions so mind-blowingly dumb, they deserve their own Netflix comedy series—let’s call it Who Approved This?!. Thankfully, Paul B. Carroll and Chunka Mui did the hard work of chronicling these mega-fails in their book Billion Dollar Lessons, a guidebook of 750 ways smart people made hilariously awful choices.

This article is your backstage pass to the most ridiculous corporate crashes in history—jam-packed with wild facts, funny stories, and simple lessons that even a middle schooler could understand (and probably avoid repeating).

1. The Oatmeal and Iced Tea Disaster: Quaker + Snapple

Imagine if your sweet grandma who makes oatmeal and knits sweaters suddenly tried to go viral on TikTok by doing dance challenges in Crocs. That’s basically what happened when Quaker Oats decided to buy Snapple for a whopping $1.7 billion in 1994. Quaker, the king of boring breakfast foods, thought, “Hey, we know how to sell oatmeal, why not sell quirky iced tea?”

What they forgot was that Snapple was the cool kid in school—full of personality, funny bottle caps, and adored by Gen Xers who wouldn’t be caught dead sipping something that smelled remotely “corporate.” Quaker, meanwhile, came in with boardroom vibes, pie charts, and a plan to sell Snapple like it was maple syrup.

They tried to shove Snapple into their traditional grocery distribution model, and fans bailed faster than a substitute teacher on a Friday. The sales tanked, the brand lost its edge, and within just three years, Quaker panic-sold Snapple for $300 million. That’s not a typo. They paid $1.7 billion, sold it for $300 million, and walked away with the kind of loss that makes accountants cry into their calculators.

What They Lost: $1.4 billion.

Fun Fact: That’s enough money to buy every oat in Canada, rent Taylor Swift for a weekend, and still have spare change to grab an actual Snapple from a gas station fridge.

2. Shower Curtains and Vodka: The Tyco Circus

Tyco’s CEO, Dennis Kozlowski, didn’t run a company — he ran a lifestyle brand for aspiring Bond villains. He treated Tyco’s bank account like Monopoly money, except the hotels were real, the champagne was flowing, and the receipts were on fire.

One of his legendary purchases? A $6,000 shower curtain. That’s not a typo. Six. Thousand. Dollars. For a curtain. It’s unclear whether it was made of Egyptian silk, angel tears, or tiny gold-plated unicorns — but at that price, it should have doubled as a time machine.

And it didn’t stop there. For his wife’s birthday, Dennis threw a $2 million party on the Italian island of Sardinia, complete with an ice sculpture of Michelangelo’s David that peed vodka. Because nothing says “happy birthday, darling” like frozen art urinating booze.

He labeled all this as “corporate expenses.” You know, standard business write-offs — toner, paperclips, and Roman bacchanals.

But while the party raged, Tyco’s financials were an actual horror movie. They had to correct $1.7 billion in fake earnings. Eventually, the boardroom turned into a courtroom, and Dennis went from CEO to “inmate #54321,” trading in his gold curtain for a gray jumpsuit and some very judgmental bunkmates.

Moral of the Story: If your CFO starts spending like a rapper and filing like a toddler, don’t ask for a meeting — ask for a warrant.

3. The Garbage Plan: Waste Management Rolls Too Hard

Waste Management had a dream. A stinky, billion-dollar dream. Their big idea? Buy up every mom-and-pop trash company they could find and become the King of Garbage — like Simba, but instead of lions and gazelles, it’s dumpsters and banana peels.

“Let’s roll them all up into one giant, efficient super-company!” they said. Spoiler alert: they rolled up alright — straight downhill.

Turns out, all those tiny companies weren’t exactly models of consistency. They had different accounting systems, mismatched billing methods, and books so messy they made Oscar the Grouch look like a neat freak. Some probably ran on handwritten notes and chewing gum.

Instead of synergy, they got spreadsheet chaos and an auditor’s worst nightmare. It was like trying to merge 50 chaotic family group chats into one civil Zoom meeting — pure delusion.

Eventually, the accounting mess got so foul that Waste Management had to clean up $1.7 billion in financial garbage. Yes, billion — with a “B.” That’s not a typo, that’s a finance felony.

Fun Fact: Rolling up garbage doesn’t give you a golden empire — it just gives you a giant, flaming landfill that smells like bankruptcy and poor judgment.

Lesson: If your corporate strategy involves the phrase “just throw it all together,” maybe don’t.

4. The Company That Invented the Future… Then Ignored It

Once upon a time in 1975, Kodak invented the digital camera. That’s right — the same company that made film rolls and disposable cameras with flash buttons that felt like detonators also created the very device that would one day obliterate their entire business.

And what did they do with this groundbreaking invention?

They buried it.

Like a scandalous family secret. Like a weird uncle you only mention after two drinks. Kodak treated the digital camera like Voldemort: it existed, but we do not speak of it.

Why? Because they were terrified it would “cannibalize” their film business. Imagine inventing the lightbulb and saying, “Let’s not tell anyone — candles are doing great this year.” Kodak didn’t just miss the boat — they built the boat, set it on fire, and waved from shore.

Meanwhile, digital cameras exploded onto the scene like TikTok influencers at a free brunch. Sony, Canon, and every other electronics company jumped in. Kodak? Still selling film like it was 1985.

By the time they blinked, Instagram was booming, selfies were an Olympic sport, and Kodak had become the Blockbuster of photography. In 2012, they filed for bankruptcy while teenagers took over the world — one filter at a time.

Lesson: If you invent the future and choose not to use it, don’t be shocked when the future deletes you.

Bonus Analogy: That’s like inventing pizza and going, “Nah, let’s stick with cabbage stew. People love cabbage, right?”

Fun Fact: Kodak actually patented the digital camera. They just decided not to market it. That’s like owning a winning lottery ticket and using it as a bookmark for your bankruptcy paperwork.

5. Lipstick and Nursing Homes? Yes, Avon Did That

Avon: the company that brought you door-to-door makeup sales, “Ding dong! Avon calling,” and catalogs your mom still keeps in her kitchen drawer… decided one day, “You know what would really complete our beauty empire? Senior living facilities.”

Yes. Retirement homes. Because obviously, when people think anti-aging, they think… assisted living.

It was a wild leap — from blush and eyeliner to blood pressure and incontinence care. Picture this: one day you’re selling lip gloss, the next you’re managing bingo night and trying to explain Medicare billing codes.

Spoiler alert: it didn’t go well.

Avon lost over $500 million in the process, proving once and for all that just because you can contour a face doesn’t mean you can run a care facility. Apparently, mascara and medication don’t mix well in a business plan.

It was the business version of a midlife crisis — except instead of buying a red sports car, Avon bought a chain of nursing homes and crashed it straight into the balance sheet.

Bonus Laugh Buffet:

- Harley-Davidson once launched a perfume line. Nothing says “freedom” like smelling like motor oil and regret.

- Colgate made frozen lasagna. Because nothing whets the appetite like associating dinner with toothpaste.

- Bic (yes, the pen company) released disposable underwear. You read that right: single-use drawers.

- Next up? Tide-brand tacos and Uber funeral services — you know, for when you need to leave… permanently.

Lesson: Just because you can diversify doesn’t mean you should. Especially if your big idea sounds like it was pitched during a Red Bull-fueled game of business Mad Libs.

6. The $5 Billion Phone That No One Needed

In the 1990s, Motorola had a dream. Not just any dream — a $5 billion, outer space-level dream. They launched a phone system called Iridium, which used 66 satellites in orbit to let you make calls from anywhere on Earth — deserts, mountaintops, international waters, awkward family reunions, you name it.

Sounds cool, right?

Well… no.

The phones were so big, they looked like a walkie-talkie had swallowed a microwave. If you tried to carry one in your pocket, it looked like you were smuggling a brick. And let’s not even talk about the antenna — it extended like a fencing sword, which was great if you wanted to poke someone while asking, “Can you hear me now?”

They were also absurdly expensive. The phone cost thousands, the subscription plan cost more than rent, and to make a call, you practically had to stand in an open field, wave at the sky, and offer a small sacrifice to the signal gods.

Oh — and the reception was worse than a dial-up modem in a thunderstorm. If you were standing indoors, near buildings, or near basically anything… good luck. You’d have better odds using smoke signals or yelling really loud.

The result? People didn’t buy them. Not even rich people. Not even James Bond. The company filed for bankruptcy within a year — one of the fastest tech faceplants in history.

Fun Fact: They spent $5 billion putting satellites in space and forgot to ask the most important question in business:

“Hey, do people actually want this?”

Bonus Thought: It’s the corporate version of building a rocket-powered scooter, launching it off a cliff, and realizing halfway down that no one asked for it — and the brakes were optional.

Lesson: Just because your idea works in theory doesn’t mean it works in a shopping mall, inside a building, or anywhere on actual Earth.

7. When Mergers Attack: AOL and Time Warner

Ah, 2000 — the year we thought the internet would solve everything. Y2K didn’t crash the world, and AOL had just finished spamming half the planet with free trial CDs. Feeling powerful (and probably invincible), AOL strutted into Time Warner’s office and said, “Hey baby, let’s merge and take over the world.”

And so, the $165 billion mega-merger was born. The idea? Marry AOL’s red-hot internet muscles with Time Warner’s legendary media empire — CNN, HBO, Warner Bros., and enough cable to hogtie the planet. On paper, it was the dream team. In reality, it was more like a cat marrying a goldfish.

AOL was fast, loud, and digital — the online wild child of the dot-com bubble. Time Warner was buttoned-up, old-school, and allergic to change. They spoke different languages: AOL said “download,” Time Warner said “fax it.” AOL wanted clicks. Time Warner wanted cable subscriptions. It was like merging a skateboard brand with a book club.

The two companies hated each other. Board meetings turned into therapy sessions. Executives clashed. Cultures collided. AOL execs showed up in hoodies. Time Warner execs wanted memos on letterhead. AOL talked memes; Time Warner talked mergers.

And while they bickered, the dot-com bubble popped like a balloon at a porcupine convention. AOL’s stock tanked. Fast. Like Titanic-meets-nosedive fast. By the time the smoke cleared, the combined company had lost $99 billion in value. That’s not a typo. That’s the GDP of a small country… gone.

It remains one of the worst mergers in history, often taught in business schools under the lesson titled: “What were you even thinking?”

Moral of the story: Just because you both like movies doesn’t mean you should move in together, share a Netflix password, and open a joint bank account. Especially if one of you still thinks the internet is a passing fad and the other thinks print magazines are a hate crime.

Bonus Fun Fact: Time Warner eventually kicked AOL to the curb like a bad date. They “unmerged” and tried to forget it ever happened — like wiping wedding photos after a two-week honeymoon that ended in small claims court.

8. The Perfect Plan That Was Perfectly Wrong

Sometimes a plan isn’t evil or dumb—it’s just so polished, so detailed, so “consultant-approved” that no one stops to ask the obvious question:

“Does this even make sense… in the real world?”

Welcome to the Land of Delusional Strategies — where executives fall in love with their PowerPoint slides, ignore customer behavior, and ride their perfect plans straight into the business graveyard.

Exhibit A: Borders + Amazon = Self-Destruction on a Silver Platter

Once upon a time, Borders was one of the biggest bookstores in the world. Massive stores, comfy chairs, overpriced coffee — a reader’s paradise. Then the internet came knocking.

Instead of building their own website, Borders said, “Eh, let’s just let Amazon handle it.” Yes.

Amazon. Their direct competitor.

That’s like Burger King asking McDonald’s to manage their drive-thru, or Blockbuster hiring Netflix to handle their streaming. What did Amazon do? Smiled, took Borders’ customers, learned their buying habits, and quietly became the Darth Vader of retail. Borders, meanwhile, ran out of bookmarks and dignity. They closed forever in 2011.

Exhibit B: Blackberry’s Button Addiction

Blackberry once ruled the mobile world. Every CEO had one. You weren’t official until you were tapping out emails on that tiny keyboard like a caffeinated squirrel. Then Apple came along with the iPhone — all screen, no buttons, and a shiny design that screamed, “the future.” Blackberry scoffed.

“Who wants a phone with no buttons?”

Answer: Everyone.

Within a few years, Blackberry was shoved into the dusty drawer of tech history — right next to floppy disks, Netscape, and people who say “I’ll fax it to you.”

Moral of the Story: A perfect plan that ignores reality is like wearing a tuxedo to a mud wrestling match — you’ll look sharp for 30 seconds and then get body-slammed by actual life.

Bonus Real Talk: If your strategy sounds amazing in the boardroom but gets laughed at by your customers, it’s not a strategy — it’s a bedtime story. And if you’re lucky, you’ll only lose your job. If you’re not, you’ll be mentioned in the next edition of Billion Dollar Lessons — right between “The $6,000 Shower Curtain” and “How to Lose $5 Billion with One Giant Phone.”

9. Netflix Who? Blockbuster’s Missed Call

Let’s rewind to the year 2000 — a simpler time when people wore low-rise jeans, burned CDs, and the height of home entertainment was renting a movie and praying it wasn’t already checked out.

Enter Netflix, a scrappy little company that mailed DVDs in red envelopes and had an idea so bold it made Blockbuster choke on its popcorn:

“Hey, wanna buy us for $50 million?”

Blockbuster executives looked at the offer and laughed so hard they probably spilled Mountain Dew on their khakis.

They said no.

Firmly.

Mockingly.

They thought Netflix was a joke.

A fad.

A silly mail-order side hustle that would disappear like dial-up internet and Beanie Babies.

Fast forward 20 years, and that “silly little startup” is now worth over $100 billion. It produces Oscar-winning films, pays comedians millions to overshare on stage, and pretty much is the entertainment industry.

Blockbuster?

There’s one store left — in Oregon. It’s basically a glorified time capsule where people take selfies next to VHS tapes and whisper, “Can you believe we had to rewind these?”

And here’s the tragic punchline: Blockbuster had the chance to launch streaming first.

They had the tech.

They had the customers.

They even tested it.

But instead of going digital, they doubled down on late fees like it was 1995 and people still used landlines. Nothing says “forward thinking” like charging grandma $7 because she forgot to return Mrs. Doubtfire.

Fun Fact: You used to have to drive to a store to rent a movie. And if they were out of copies, you just stood there, staring at an empty shelf and questioning your life choices.

Lesson: Never underestimate a nerd with a good idea and a DVD — because that nerd might one day hire Shonda Rhimes, win an Emmy, and tell your story in a documentary titled “The Last Blockbuster.”

Alternate Moral: If a hoodie-wearing founder with a quirky idea walks into your office… maybe don’t laugh. Invest. Or at least don’t roast them while your own business model is one missed rewind away from extinction.

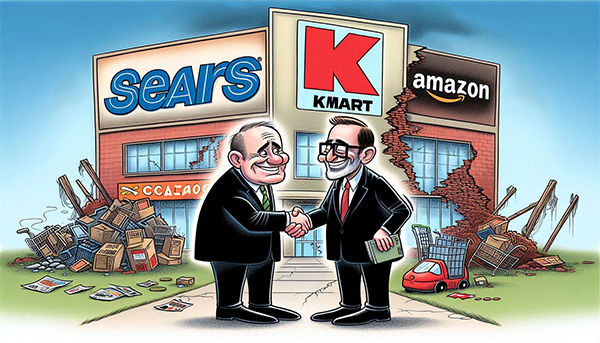

10. Sears: From Amazon Before Amazon to… Kmart?

Once upon a time — before Jeff Bezos had hair and while dinosaurs still used dial-up — Sears was the everything store. Think about it: they sold houses (yes, real mail-order houses), cars, clothes, tools, toys, even chickens. You could flip through a Sears catalog and order your entire life.

They were basically Amazon with a stapler.

Sears was the original online shopping — if by “online,” you mean circling items in a 600-page paper catalog with a crayon while eating cereal at the kitchen table. So what did Sears do when the internet arrived, practically begging for them to step up and dominate e-commerce?

They blinked. Shrugged. And then said:

“You know what’ll solve everything? Let’s merge with Kmart.”

Yes. Kmart. The discount store where dreams — and usually the lights — go to die.

It was like marrying your broke cousin because you both once had jobs in the ’80s.

The result? A retail version of the zombie apocalypse. No apps. No digital strategy. No idea what century it was. While Amazon was out here building drones and cloud empires, Sears was still trying to sell snowblowers out of a sad, half-lit warehouse next to a Kmart that smelled like regret and expired hand soap.

Together, the Sears-Kmart fusion limped along for years like a VHS tape stuck in a DVD world — slowly fading into irrelevance while customers ran (or clicked) to literally any other store.

Fun Fact: Sears could’ve invented online shopping. Instead, they invented “How to Lose $13 Billion While Staring at a Fax Machine.”

Lesson: If you were Amazon before Amazon, don’t turn yourself into a flea market with flickering fluorescent lights. That’s not transformation — that’s slow-motion retail suicide with a Blue Light Special.

Bonus Burn: Sears had the tools, the customer base, the infrastructure, and even early web traffic. They just didn’t have one crucial thing: a clue.

Final Thought: Don’t Be the Punchline

The businesses in Billion Dollar Lessons didn’t crash and burn because of bad luck, solar flares, or a cursed spreadsheet.

They failed because they didn’t listen, didn’t adapt, and genuinely believed their vibe could beat reality. Spoiler: reality always wins — and it doesn’t care how visionary your PowerPoint looks in a dark room.

These weren’t mom-and-pop shops. These were billion-dollar empires run by people in $2,000 suits who thought “consumer feedback” was a myth invented by interns.

And yet, here we are — picking through the wreckage of gold-plated shower curtains, frozen toothpaste lasagna, and brick-sized phones you could use as gym equipment.

If you’re ever in a meeting and someone says,

“Don’t worry — this time it’s different…”

Run.

Run like a Blockbuster executive in 2005 who just saw a Netflix envelope.

Because history has receipts.

And remember:

- Failing is normal.

- Learning is powerful.

- But losing a billion dollars because of a vodka-peeing ice sculpture or letting Amazon run your store?

That’s not innovation. That’s corporate Darwinism with a laugh track.

Final Lesson: The smartest people in the room are usually the ones still asking questions — not the ones ordering gold-plated drapes and planning victory parades during the pilot phase.

So go ahead — dream big, take risks, fail proudly.

Just don’t be the case study everyone laughs at in business school.

The End. Now go make smarter mistakes.

Closing Quote to Live By:

“In war, politics, and business, the enemy announces himself. But strategic stupidity? That comes wearing a suit, holding a synergy report, and asking if you’ve thought about rebranding.”

Sources:

- Billion Dollar Lessons by Paul B. Carroll & Chunka Mui

- chunkamui.com

- Public filings, business news archives, and more stories than your MBA professor warned you about.

About the Author

John is an entrepreneur, strategist, and founder of JS Morlu, LLC, a Virginia based CPA firm with multiple software ventures including www.FinovatePro.com, www.Recksoft.com and www.Fixaars.com . With operations spanning multiple countries, John is on a mission to build global infrastructure that empowers small businesses, entrepreneurs, and professionals to thrive in an increasingly competitive world. He believes in hard truths, smart execution, and the relentless pursuit of excellence. When he’s not writing or building, he’s challenging someone to a productivity contest—or inventing software that automates it.

JS Morlu LLC is a top-tier accounting firm based in Woodbridge, Virginia, with a team of highly experienced and qualified CPAs and business advisors. We are dedicated to providing comprehensive accounting, tax, and business advisory services to clients throughout the Washington, D.C. Metro Area and the surrounding regions. With over a decade of experience, we have cultivated a deep understanding of our clients’ needs and aspirations. We recognize that our clients seek more than just value-added accounting services; they seek a trusted partner who can guide them towards achieving their business goals and personal financial well-being.

Talk to us || What our clients says about us