Retirement planning, it’s crucial for a secure future. But what happens when your nest egg starts growing instead of shrinking? Required Minimum Distributions (RMDs) come into play, ensuring the taxman gets his due from your qualified retirement accounts like IRAs and 401(k)s. Navigating the world of RMDs can be tricky, but fear not! This guide unpacks everything you need to know, from when you need to start taking them to avoiding costly penalties.

What are RMDs?

Simply put, RMDs are mandatory withdrawals you must make from your retirement accounts starting at a certain age. Think of it as “breaking the seal” on your tax-deferred savings, gradually bringing them into the taxable fold. Failure to take your RMDs can result in a steep 50% penalty on the undistributed amount – ouch!

When do RMDs kick in?

For most folks, the RMD clock starts ticking at age 72 (previously 70.5). However, if you turned 72 in 2022, you get a temporary reprieve – you can delay your first RMD until April 3, 2023. Just be mindful, delaying that first distribution means double duty in 2023, potentially pushing you into a higher tax bracket.

Calculating your RMD

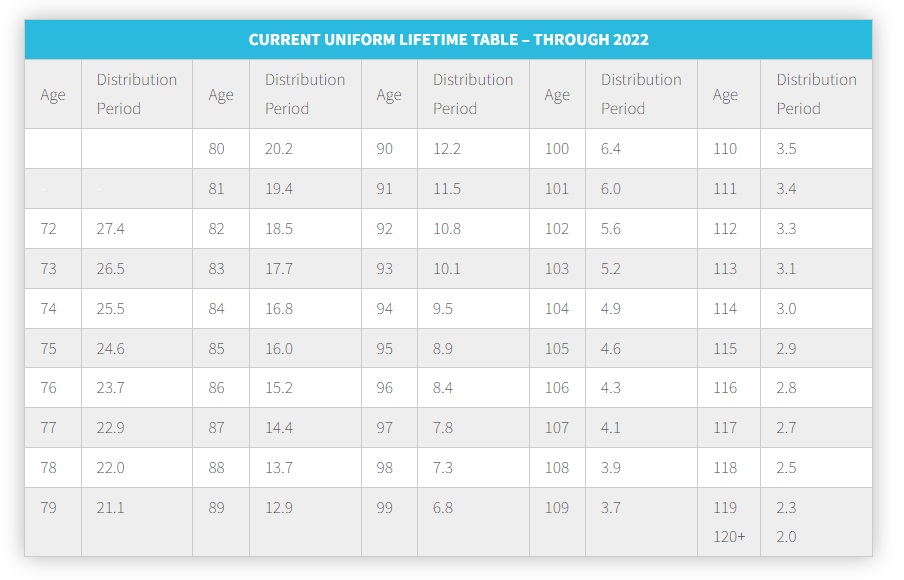

The magic formula for your RMD involves two key ingredients: the value of your retirement accounts and your life expectancy. The IRS provides a handy Uniform Lifetime Table that assigns a “distribution period” based on your age. Divide your account value by this period, and voila, you have your RMD for the year.

New table, new numbers

Heads up! A new Uniform Lifetime Table came into effect in 2022, meaning slightly longer life expectancies and potentially lower RMDs for some folks. Check out the table to see how it affects your withdrawal numbers.

Multiple accounts, more complexity

Got a 401(k) alongside your IRA? Things get a bit more intricate. You need to calculate RMDs for each account separately and can’t use withdrawals from one to fulfill the obligation of the other. Seeking professional guidance can be your best bet in such scenarios.

Don’t wait until the last minute!

Remember, December 31st might not be a business day, and financial institutions often take a holiday break too. So, don’t procrastinate on your RMDs. Plan ahead, and ensure you distribute the required amount before the year ends.

Still have questions?

Fear not! We’re here to help. Contact us today for personalized guidance on navigating the complexities of RMDs and ensuring your retirement nest egg stays happy and healthy.

JS Morlu LLC is a top-tier accounting firm based in Woodbridge, Virginia, with a team of highly experienced and qualified CPAs and business advisors. We are dedicated to providing comprehensive accounting, tax, and business advisory services to clients throughout the Washington, D.C. Metro Area and the surrounding regions. With over a decade of experience, we have cultivated a deep understanding of our clients’ needs and aspirations. We recognize that our clients seek more than just value-added accounting services; they seek a trusted partner who can guide them towards achieving their business goals and personal financial well-being.

Talk to us || What our clients says about us