Electric vehicles (EVs) are surging in popularity, and for good reason! They offer a clean, eco-friendly alternative to traditional gasoline-powered cars. But on top of environmental benefits, the US government is offering tax credits to incentivize EV purchases. This guide will navigate the ins and outs of these clean vehicle tax credits, ensuring you make informed decisions to maximize your savings.

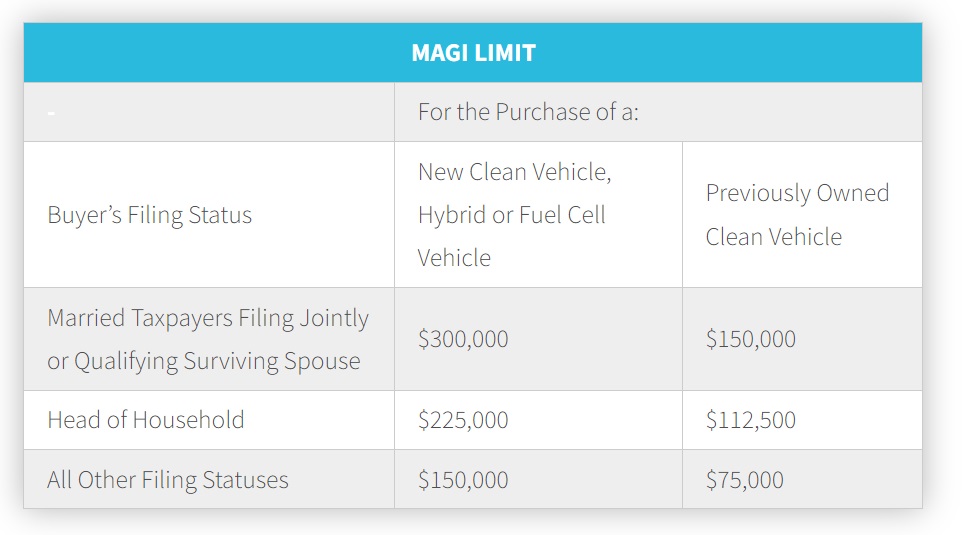

Crucial Income Limits: Are You Eligible?

Before diving into specifics, let’s address the most critical factor: income limitations. These credits are not a one-size-fits-all solution. The Internal Revenue Service (IRS) sets Modified Adjusted Gross Income (MAGI) limits to determine eligibility. Here’s a breakdown:

The good news? You can choose your MAGI from either the year you buy the vehicle or the prior year, whichever benefits you most.

New Clean Vehicles: A Closer Look

If you’re eyeing a brand new EV, here’s what you need to know:

- North American Assembly: The vehicle must be assembled in North America to qualify.

- Manufacturer’s Suggested Retail Price (MSRP) Caps: Keep an eye on the MSRP. For vans, pickups, and SUVs, the limit is $80,000. For all other vehicles, it’s $55,000.

- Battery Requirements: The battery capacity must be at least 7 kilowatt-hours (kWh) or greater.

- Critical Mineral and Battery Component Regulations: As of April 18, 2023, there are additional regulations regarding the origin of critical minerals and battery components. These regulations aim to lessen dependence on foreign sources. The Department of Energy website offers a helpful tool to search for qualifying vehicles. This tool also indicates the maximum credit amount (capped at $7,500).

Previously Owned Clean Vehicles: A Different Set of Rules

The rules for pre-owned EVs differ slightly:

- Model Year: The model year must be at least two years older than the year you purchase the vehicle.

- Original Ownership: The vehicle cannot be brand new to you; it must have had a previous owner.

- Qualified Sale: The purchase must meet specific criteria, including a maximum price of $25,000 and being the first transfer to a qualified buyer since the credit’s enactment.

- Weight and Battery Capacity: Luckily, the government provides a list of qualifying pre-owned vehicles that meet weight (under 14,000 pounds) and battery capacity (at least 7 kWh) requirements.

- Qualified Buyer: To be considered a qualified buyer, you must be purchasing the vehicle for personal use, not resale, and cannot be claimed as a dependent on another’s tax return. Additionally, you cannot have claimed a credit for a pre-owned clean vehicle in the past three years.

Credit Details: How Much Can You Save?

If you qualify as a buyer of a previously owned clean vehicle, you can claim a tax credit equal to the lesser of:

- $4,000

- 30% of the vehicle’s sale price

Dealer Reports and Tax Implications

Whether you buy new or pre-owned, the dealer is required to provide a report to both you and the IRS. This report includes details like your name, tax ID, battery capacity, vehicle identification number (VIN), and the maximum credit available. For pre-owned vehicles, the purchase price is also included. This report serves two purposes: providing you with information for claiming the credit and preventing fraudulent claims. Make sure to retain this report for tax filing purposes.

Important Note: Understanding Your Tax Benefit

It’s crucial to remember that these credits are non-refundable. Any unused portion doesn’t carry over to the next year. The credit simply reduces your tax liability. Depending on your tax situation, you may not benefit from the full amount or may not benefit at all. Consulting a tax professional can help you determine the potential tax benefits of a clean vehicle credit and avoid any surprises come tax time.

Future Considerations: Transferring Credits to Dealers (Coming Soon!)

While currently unavailable (as of 2024), the future holds promise for even greater convenience. The option to transfer the clean vehicle credit directly to the dealer in exchange for a reduced purchase price is expected to be available after 2023. This can significantly lower your upfront costs. However, be mindful of a potential tax pitfall. If your MAGI for the current or preceding year exceeds the applicable limit after claiming the credit upfront, you might be required to repay the credit amount on your tax return for the year the vehicle was purchased.

Conclusion: Making Informed Decisions

The landscape of clean vehicle tax credits can be complex, but with careful planning and the help of this guide, you can navigate the requirements and maximize your potential savings. Remember, staying informed about the latest regulations and consulting a tax professional are key steps towards making a smart and financially rewarding decision when purchasing a clean vehicle. By going electric and taking advantage of these tax credits, you’ll contribute to a cleaner environment and enjoy the ride towards a sustainable future!

JS Morlu LLC is a top-tier accounting firm based in Woodbridge, Virginia, with a team of highly experienced and qualified CPAs and business advisors. We are dedicated to providing comprehensive accounting, tax, and business advisory services to clients throughout the Washington, D.C. Metro Area and the surrounding regions. With over a decade of experience, we have cultivated a deep understanding of our clients’ needs and aspirations. We recognize that our clients seek more than just value-added accounting services; they seek a trusted partner who can guide them towards achieving their business goals and personal financial well-being.

Talk to us || What our clients says about us