By: John S. Morlu II, CPA

Introduction

Imagine the startup world as a thrilling high-stakes poker game. You’ve got your founders, investors, employees, and sometimes even mom and dad, all eager to place their bets on the next big thing. Each player brings their unique skills to the table, whether it’s the founder’s vision, the investor’s capital, or the employee’s hard work. They’re all there, eyes glued to the cards, waiting for the moment when they can cash in their chips and celebrate their collective success.

But what happens when the game reaches its climax, and it’s time to divvy up the winnings? That’s where the magical (and often misunderstood) world of liquidation events, liquidation preferences, and exit value comes into play. This intricate dance of finance determines how the spoils are shared among the players, setting the stage for future successes—or, in some cases, heart-wrenching losses.

Liquidation events are pivotal moments in the lifecycle of a startup, representing the culmination of years of hard work, dedication, and sometimes a fair share of risk-taking. These events can take various forms, including acquisitions, mergers, and initial public offerings (IPOs). Understanding how these events operate is crucial not only for founders looking to secure a lucrative exit but also for investors and employees who have placed their bets on the company’s future.

As we journey through this complex landscape, we’ll uncover the nuances of liquidation preferences—the rules that dictate who gets paid first when the chips are down—and the concept of exit value, which measures the ultimate financial success of these ventures. Get ready for a captivating exploration filled with fascinating tidbits, a sprinkle of humor, and invaluable insights that demystify the financial mechanics at play.

So, hold onto your hats, folks! This financial ride will be equal parts enlightening and entertaining, providing you with the knowledge to navigate the high-stakes game of startups with confidence and flair. Whether you’re a founder, an investor, or simply a curious observer, you’ll leave this discussion armed with a deeper understanding of the strategies and considerations that drive the startup ecosystem.

Chapter 1: Liquidation Events: The Moment Everyone’s Been Waiting For

In the world of startups, a liquidation event is akin to the grand finale of a fireworks show—an exhilarating spectacle that captures the attention of all. It’s that much-anticipated moment when a company either sells, merges with another entity, or, regrettably, declares bankruptcy. In simpler terms, it’s the pivotal event that can either make or break your investment. All equity holders—the founders, investors, and employees—gather to see who will walk away with a substantial slice of the pie (hopefully not just crumbs).

The Types of Liquidation Events

Liquidation events can be categorized into three primary types:

- Acquisition (The Happy Dance): This occurs when a larger company purchases your startup for a lump sum. It’s the moment when most people get to pop the champagne and exclaim, “I’m rich!” The celebration is widespread, and everyone involved shares in the joy of a lucrative exit.

- Mergers (The Complicated Tango): In this scenario, two companies unite to form a new entity. Think of it as a corporate marriage—assets, liabilities, and everything in between get combined. Shareholders receive stakes in the newly formed company, but who gets what can depend heavily on their initial investment and any liquidation preferences in place. Cue the dramatic music!

- Bankruptcy (The Tragic Ending): If the startup story doesn’t have a happy ending, bankruptcy is the unwelcome visitor. In this case, cash is scarce, and while creditors and certain investors might recoup some losses, founders often receive little to nothing.

- Initial Public Offering (IPO) (The Glitzy Liquidation Event): Among the most glamorous liquidation events, an IPO marks the moment a private company goes public. It’s akin to a dazzling red-carpet premiere, where investors and founders finally get the chance to cash in on their hard-earned shares.

Let’s delve into this glittering moment in the context of liquidation events and explore how an IPO fits into the broader narrative of exiting a startup.

IPO: The Glitzy Liquidation Event

Imagine this: after years of relentless effort, sleepless nights, and more than a few ramen noodle dinners, your startup has finally “made it.” What’s next? An IPO, where your company’s shares are sold to the public for the very first time. It’s like your startup transitioning from indie darling to Hollywood blockbuster overnight, allowing investors and founders to finally witness their equity transform into cold, hard cash.

In the startup realm, an IPO is often regarded as the golden exit strategy, enabling all parties involved to walk away with a significant financial windfall. Not only does it provide early investors a chance to cash out, but it also generally results in a substantial payday for founders, employees, and even those family members who invested early on.

What Happens in an IPO?

During an IPO, the company lists its shares on a stock exchange such as the New York Stock Exchange (NYSE) or Nasdaq. Shares that were previously privately held are now available for the public to purchase, transforming the once-exclusive poker game into a public affair open to anyone with cash to spend.

Once the company goes public, the value of those shares fluctuates based on demand, investor confidence, and, of course, financial performance.

Why an IPO is Considered a Liquidation Event

An IPO qualifies as a liquidation event because it provides a means for early investors, founders, and employees to convert their equity—previously locked away in the company—into liquidity (cash or publicly traded stock that can be sold). It’s the moment when years of sweat equity can pay off dramatically—cue the fireworks!

However, the excitement is tempered by reality. Founders and early employees often must endure a lock-up period (typically six months) before they can sell their shares. Once that lock-up expires, it’s time for a potential payday—assuming the stock price hasn’t tanked.

Fun Fact

Remember when Facebook went public in 2012? It was one of the most highly anticipated IPOs of the decade. Founder Mark Zuckerberg famously wore a hoodie to ring the Nasdaq opening bell, sending a clear message that IPOs could be just as casual as they are high-stakes!

The Good, the Bad, and the Ugly of IPOs

- The Good: If your company has been on a steady growth trajectory, and public investors are optimistic about its future, an IPO can lead to massive payouts for early investors and founders. Companies like Google, Amazon, and Apple have used IPOs as springboards for global domination. Moreover, an IPO typically generates an influx of cash from the sale of shares, which can be reinvested into growth, product development, or even that shiny new office in Silicon Valley.

- The Bad: Going public brings a new level of scrutiny. Your financials, strategy, and performance are now under the watchful eye of the public, and investors can be unforgiving if quarterly earnings fall short. Additionally, you’ll face more regulatory and transparency requirements (like filing quarterly reports) than you ever did as a private company.

- The Ugly: Not all IPOs are equal. Some companies may debut at a high valuation, only to see their stock price plummet shortly after. Just ask WeWork, whose much-hyped IPO plans collapsed dramatically in 2019 after investors raised concerns about its financials and quirky corporate governance. An IPO doesn’t guarantee success, but when it works, it can be a financial game-changer.

IPO vs. Other Liquidation Events

Let’s compare an IPO with other common liquidation events, such as an acquisition or merger:

- IPO vs. Acquisition: In an acquisition, a larger company buys your startup outright, compensating shareholders in cash, stock, or a mix of both. Conversely, in an IPO, your company remains independent, simply allowing public shareholders to join the ownership. The advantage of an IPO? If your stock performs well, your shares could be worth significantly more than what you might receive in a one-time acquisition deal.

- IPO vs. Merger: Mergers often focus on consolidation—combining two companies to create a new entity. Post-IPO, you retain your identity as a standalone company, albeit with a larger pool of shareholders and public investors demanding performance. In a merger, shareholders typically receive stock in the new entity, while an IPO allows them to sell their stock on the public market for a quicker payout.

- IPO vs. Bankruptcy: Clearly, IPOs stand in stark contrast to bankruptcies. In a bankruptcy liquidation event, your assets are liquidated to pay creditors, leaving little to nothing for equity holders. Conversely, an IPO signifies triumph—unless, of course, your stock price crashes post-IPO.

How Liquidation Preferences Affect IPOs

Those pesky liquidation preferences don’t vanish just because you’re going public. When a company IPOs, the liquidation preference clauses in investors’ contracts come into play. Investors with preferred stock (the ones holding liquidation preferences) generally have two options:

1. Convert their preferred shares into common stock at a pre-determined rate, opting for this only if it’s more lucrative than cashing out as regular shareholders.

2. Stick with their liquidation preference and receive payment before anyone else. For instance, if an investor has a 1x liquidation preference and invested $5 million, they’ll get at least that $5 million back, irrespective of the company’s stock performance post-IPO.

The silver lining? In most successful IPOs, the stock price is high enough that investors typically prefer to convert their preferred shares into common stock, as this results in greater profits.

The downside? If your company goes public at a lackluster valuation, those liquidation preferences could mean that early investors still walk away with a substantial payout while common shareholders (including employees) see significantly less.

Fun Fact

Google’s 2004 IPO was a bit unconventional. The company went public through a Dutch auction, allowing investors to bid on how many shares they wanted and at what price. Although the IPO was successful, it strayed from a typical Wall Street offering—initially raising skepticism among some investors.

IPOs and Exit Value: The Big Payoff?

Now, let’s tie it all together. When a company undergoes an IPO, the exit value is the market value based on the price of the shares sold to the public. The higher the share price, the greater the exit value, and theoretically, the more money everyone makes.

For instance, if your company’s IPO price is $50 per share, and you issue 1 million shares, your company’s initial market cap (or exit value) is $50 million. However, this is merely the starting point—once trading commences, the market will dictate the company’s true worth.

Key Insight

The exit value of an IPO is not fixed. It fluctuates based on investor confidence, market trends, and financial performance. For some companies, going public is just the beginning of their journey (think Amazon and Google), while for others, it might represent the pinnacle of their success.

IPOs—The Shiny Crown Jewel of Liquidation Events

An IPO is often viewed as the holy grail of liquidation events—a flashy opportunity for founders, investors, and employees to finally cash out their shares and potentially strike it rich. Yet, as with all things in the startup world, the devil is in the details. Liquidation preferences, stock lock-up periods, and market performance all play crucial roles in determining the actual payout.

Whether it’s an IPO, an acquisition, or even the occasional bankruptcy, liquidation events are pivotal moments in any company’s journey. When executed successfully, an IPO can represent the ultimate payday—a celebration for everyone involved (and perhaps even a chance to retire) after years of hard work.

So, keep dreaming big, and remember that every startup story has the potential for a blockbuster ending—if you navigate the journey wisely!

Chapter 2: Types of Liquidation Preferences

Welcome back to the wild world of liquidation preferences, where money talks, and sometimes it shouts! Grab your favorite snack (preferably something you can share) and let’s dig into the types of liquidation preferences that can make or break a startup deal.

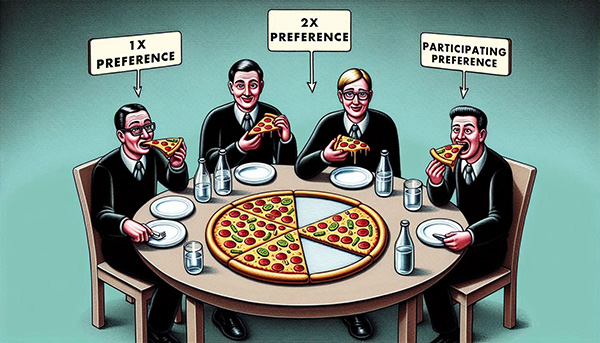

1x Liquidation Preference: The Classic Choice

Let’s kick things off with the most common player on the field: the 1x liquidation preference. Picture it like this: you invite your friend over for pizza, and they insist on getting their money back for the toppings before anyone else can take a slice. So, if an investor plops down $1 million, they’ll get their full million back before any of the other guests (a.k.a. shareholders) even think about taking a bite.

Fun Fact: Here’s where it gets juicy: some liquidation preferences are like that friend who not only wants their topping money back but also wants a second helping of pizza! Enter the “participating preferences.” Not only do they get their million back, but they also get to feast on any leftover profits as if they’ve just won a pizza buffet contest. Cruel, but clever, right? It’s like they’ve got their cake, eaten it, and then snuck a slice from your dessert plate!

2x or 3x Liquidation Preference: Greed is Good

Next up, we have the double trouble: the 2x and 3x liquidation preferences. Think of this as your investors putting on their ice cream cones and demanding extra scoops. If an investor with a 2x preference plops down $1 million, they’re now eyeing a whopping $2 million before anyone else sees a single dime. It’s like a double-dip cone—but without the laughter, joy, or sprinkles for the founders.

Fun Fact: Why go for just one scoop when you can have two or three? The higher the multiple, the more your investors are hedging their bets. If your startup doesn’t knock it out of the park, they’re still waltzing away with double or triple their investment. Sneaky but strategic, right? Just think of them as risk-takers with a taste for creamier profits!

Participating vs. Non-Participating Preferences: The Snack Dilemma

Now, let’s break down the two main types of preferences:

- Participating Preference (aka Double Dip): Imagine you’re at a party where the investor gets first dibs on all the snacks—everyone knows the rule: investors get their pick first. But wait! After they’ve gobbled down their preferred snacks, they get to rejoin the snack line for seconds! This is participating preference in action. They get their liquidation preference AND their share of any remaining proceeds. Talk about a win-win for them!

- Non-Participating Preference: In a more democratic system, the investor gets their liquidation preference but doesn’t get to munch on the leftovers. Once they’ve snagged their initial investment back (or their 2x, 3x, etc.), the rest of the loot goes to the rest of the partygoers. It’s like saying, “Hey, thanks for your investment! Now please pass the chips to the people who actually did the hard work!”

Why Liquidation Preferences Matter (and Why Founders Need to Be Careful)

Now, let’s get serious for a moment. If you’re not careful as a founder, liquidation preferences can sneak up on you and turn what seemed like a massive payday into a sob story. Picture this: your startup sells for $10 million, but you’ve got investors with a 2x liquidation preference who invested $5 million. Guess what? They’re walking away with the full $10 million, and you’re left with a nice round sum of… zero. Ouch.

Moral of the story: Make sure you fully understand the preferences you’re agreeing to before you take on investors. It’s like reading the fine print on a coupon—neglect it, and you might find yourself walking away with nothing after all your hard work. Nobody wants to end up in a horror story where the investors feast and the founders starve!

Exit Value: The Big Price Tag

Now that we’ve navigated the murky waters of liquidation preferences, let’s chat about exit value—the golden number that glimmers in the distance, calling out like a siren. The exit value is simply the amount a company is worth when it’s sold, merged, or liquidated. It’s that moment when the value of the entire company is converted into hard, cold cash (or at least a check).

The higher the exit value, the bigger the potential payday for investors, founders, and employees alike. So, as you chart your course through the startup seas, remember: aim for that exit value like it’s the ultimate treasure map. Just be cautious of those pesky liquidation preferences lurking nearby, waiting to grab their share of the booty before you can even say “jackpot!”

Chapter 3: How Exit Value is Determined

Welcome to the thrilling rollercoaster ride of exit valuation! Buckle up, because this is where the fun—and possibly the stress—begins. Valuing a company isn’t as straightforward as checking your bank balance and sighing over your coffee (although that’s a daily ritual for many). Nope! The exit value is a cocktail of factors that, when mixed just right, can lead to a big payout or a dramatic flop. Let’s dive into the elements that determine the exit value of your startup, with a sprinkle of humor and a dollop of common sense along the way!

1. Revenue and Profitability: The Cash Flow Kings

First on our list is the all-important revenue and profitability. If your startup is raking in the big bucks and swimming in a sea of green, it’s going to fetch a higher price at the exit. Think of it like this: if your company were a pizza, a hefty profit means it’s loaded with extra cheese and toppings. The more delicious your financials look, the more someone is willing to pay to snag a slice!

Pro Tip: Investors love to see strong revenue growth. So, if you’re currently drowning in expenses, it might be time to swap your pepperoni for some prudent cost-cutting!

2. Market Growth: Riding the Wave

Next up, let’s talk market growth. Investors and acquirers love a good trend—who doesn’t? If you’re in a booming industry like AI or clean energy, your startup might just get a shiny higher valuation. Meanwhile, if you’re operating in a shrinking market (no offense to typewriter manufacturers), your exit value might resemble a sad, deflated balloon.

Fun Tidbit: Remember, it’s not just about what you’re selling; it’s about the potential for growth. If you’re in a hot market, you might be sitting on a goldmine, just waiting for the right buyer to come along!

3. Competitive Advantage: The Secret Sauce

Now let’s spice things up with competitive advantage. If your startup has a killer product or service that nobody else can touch, congratulations! You’re looking at a higher exit value. Think of it as having the secret sauce that everyone wants—your recipe is unique, and competitors are just left licking their spoons in envy.

Insightful Note: The key is to protect that secret sauce! Patents, trademarks, and a strong brand can make your startup irresistible to potential buyers.

4. Strategic Value: More Than Just Numbers

Here’s where things get interesting: strategic value. Sometimes, companies will buy you not just for your financials but for your tech, your talented team, or your market share. It’s like being the popular kid in school who gets invited to all the parties, even if they’re not the best at any subject. You might not have the highest grades (financials), but your charm (tech or talent) can snag you a golden ticket to a sweet exit.

Pro Tip: Be ready to showcase your startup’s unique value beyond just profits. Your tech might solve a problem that no one else can, making you a hot commodity!

5. Multiple on Revenue or Earnings: The Math Game

And then there’s the age-old method of valuation: multiples on revenue or earnings. Many companies are valued using a multiple of their revenue or profits. For instance, if your company is valued at 5x its annual revenue, that’s a quick way for investors to gauge your worth.

Fun Fact: Investors often compare similar companies within the industry to determine the right multiple. So, if you’ve got a stellar year, you might just find yourself dancing in the multiples, raking in those big bucks!

Fun Fact: Unicorns, the Mythical Creatures of the Startup World

And now, for a magical interlude! The unicorn phenomenon refers to startups valued at over $1 billion. Companies like Uber, Airbnb, and Stripe all earned their unicorn horns in massive exit deals. But why unicorns, you ask? Because they were once considered mythical, rare beasts—much like those billion-dollar startups. So, if you’re aiming for unicorn status, keep your eyes on the prize, and remember: every unicorn started as just another horse with a dream!

Wrapping It Up: The Exit Value Formula

So, what have we learned today? Determining your startup’s exit value is like baking a cake: you need the right ingredients (revenue, market growth, competitive advantage, strategic value, and the ever-important multiples). Mix them all together, bake it in the hot oven of market conditions, and voilà! You’ve got a delicious exit value waiting to be served.

As you venture into the world of exit strategies, keep these factors in mind. Navigate wisely, and you just might find yourself celebrating your exit with a confetti cannon instead of a sad trombone. Ready to move on to the next chapter, or shall we keep the fun rolling here?

Chapter 4: The Exit Math: Who Gets What?

Welcome to the thrilling world of exit math, where numbers dance and dollars are on the line! Grab your calculator (or your favorite cocktail—whatever helps you crunch those numbers) as we break down how the pie gets sliced when your startup makes its grand exit. Spoiler alert: It’s not just about the size of your slice; it’s about who’s in the kitchen and how many chefs are vying for that sweet, sweet cake!

The Hypothetical Scenario: A Delicious $50 Million Exit

Let’s set the stage: your brilliant startup just sold for a whopping $50 million. Congratulations! Cue the confetti, the fireworks, and maybe even a marching band because you’ve hit the jackpot. But wait! Before you get too excited, let’s see who’s grabbing the biggest slices of this financial pie.

- Investor A has a 1x liquidation preference and invested $5 million.

- Investor B has a 2x liquidation preference and invested $10 million.

- You and your co-founders own 40% of the company.

The Math Breakdown: Who Gets What?

Now, let’s roll up our sleeves and dive into the numbers:

- Investor A: With their 1x liquidation preference, they get their $5 million back first. No negotiations here! It’s like they walked into a party and immediately claimed the first slice of pizza.

- Investor B: With a 2x liquidation preference, they’re not just getting their initial investment back; they’re taking home a juicy $20 million (2 times their $10 million investment). Talk about a double-dip! It’s like they ordered the extra-large pizza, and they’re not sharing.

- After these two investors have taken their cuts, we’ve got $25 million left on the table. But wait! Don’t start celebrating just yet—there’s more to the story.

The Shareholder Slice: Your Time to Shine

With $25 million remaining, it’s time for you and your co-founders to dig in. Since you own 40% of the company, your slice of the remaining funds is calculated like this:

- $25 million x 40% = $10 million.

So, you and your co-founders each walk away with a respectable $10 million! Not too shabby, right? It’s a reason to pop some bubbly and toast to your entrepreneurial journey.

The Catch: Terms Matter!

Now, let’s pump the brakes for a moment. While this scenario seems pretty sweet, it’s crucial to remember that it all hinges on the terms you agreed to at the beginning. Think of it as a restaurant menu—if you don’t read the fine print, you might end up with a side of regret instead of that delicious entrée you were expecting!

Common Sense Tip: Always ensure you fully understand the terms of the investment and the liquidation preferences before signing on the dotted line. It could mean the difference between enjoying a feast or nibbling on crumbs after a successful exit.

Fun Fact: The “Last-In, First-Out” Game

Ever heard of the term “last in, first out”? In the investment world, it’s the opposite! The earlier investors typically have more favorable terms, which means they’re getting paid first. So, if you’re a founder, it’s like being at a potluck where your friends with the first dibs get to eat before you can even see what’s on the table. You might want to reconsider who you invite next time!

Wrapping Up the Math: Everyone Leaves Happy (Mostly)

So there you have it! Your startup’s exit is like a financial buffet, where everyone gets to fill their plates—just in a specific order. Understanding the math and the preferences can help you strategize for the best possible outcome.

In our hypothetical scenario, Investor A and Investor B walked away with their respective portions, and you and your co-founders enjoyed a healthy payout as well. It’s a win-win… sort of!

Just remember, the exit math can be tricky, and it all comes down to the agreements you make along the way. Keep your eyes on the prize, and ensure you’re equipped with the right knowledge to navigate the twists and turns of startup funding.

Now that we’ve untangled the numbers, are you ready to conquer the next chapter, or is there more math magic you’d like to explore?

Chapter 5: Wrapping It All Up

Ah, the grand finale! Just like the last episode of your favorite series, it’s time to wrap everything up, reflect on the drama, and maybe even drop a few wisdom bombs along the way. When it comes to liquidation events, preferences, and exit values, there’s a common thread weaving through all the financial jargon: it’s all about the money, honey!

Money Talks: The Real MVP

At the end of the day, the question everyone wants answered is simple: Who gets the dough and how much? It’s like hosting a family reunion potluck—everyone’s bringing a dish, but when it’s time to eat, you realize Aunt Mildred brought three giant casseroles and claimed the biggest slice of the dessert! Talk about a feast… or a food fight waiting to happen!

In this game, the rules can feel like they’re shifting with every deal. One moment, you’re rolling in the chips, and the next, it feels like everyone’s ready to cash in. But fear not! If you play your cards right (and maybe throw in a bit of charm), everyone can leave the table with a smile—if not a full belly, then at least not in tears.

Surfing Through the Liquidation Waves

Now, I know navigating these financial waters can seem a bit intimidating—like trying to surf for the first time while the waves look more like monstrous tsunamis. But with the right knowledge, a good sense of humor, and perhaps a mental image of a cute puppy surfing right alongside you, it can feel less like drowning and more like riding the waves toward that epic exit!

Imagine this: you’re on your board, feeling the rush as you glide effortlessly towards the shore of financial freedom. High-fives and dollar signs are flying in every direction, and the only tears you’re shedding are joyful ones as you celebrate your victory!

The Grand Pizza Analogy

Now, here’s a thought: picture your startup exit as a gigantic pizza party. Everyone’s excited, but if you’re not careful, you might end up with just a crust while your investors snag all the toppings! So what’s the moral of the story? Communication is key! Be sure everyone knows who gets which slice before the pizza is served.

Pro Tip: Consider putting a “no double-dipping” rule in place, especially if one investor likes to take their fair share and then swoop in for the leftover toppings. Nobody wants to be that person at the party—unless they’ve got an excellent sense of humor about it.

Every Pie Can Be Big Enough

Whether you’re a founder planning your grand exit like a Hollywood blockbuster or an investor on the hunt for the next unicorn, remember this: the pie can be big enough for everyone. With the right strategy, some savvy negotiations, and perhaps a sprinkle of charm, you can ensure that everyone leaves with a satisfying slice of that proverbial pie.

But, let’s be real—sometimes, someone’s going to take a double dip. It’s just the way of the world! So, learn to navigate these waters with a bit of laughter and a good sense of humor. After all, every good story needs a little drama, right?

Final Thoughts: Keep It Light

In the end, as you dive into the world of liquidation and exit strategies, keep things light-hearted and remember: you’re not just playing for the money; you’re playing for the fun, the friendships, and the fantastic experiences that come along with this wild entrepreneurial ride.

So go forth, brave founders and savvy investors! Surf those liquidation waves, keep your eyes on the prize, and may your exit be filled with laughter, learning, and maybe a few extra toppings on your financial pizza. Who knows? You might just create a recipe for success that everyone wants a piece of.

And remember, when it comes to money and exit strategies, keep the humor alive, and you’ll be riding high on those dollar signs in no time! Cheers to epic exits and the joy of navigating the beautiful chaos of entrepreneurship!

Author: John S. Morlu II, CPA is the CEO and Chief Strategist of JS Morlu, leads a globally recognized public accounting and management consultancy firm. Under his visionary leadership, JS Morlu has become a pioneer in developing cutting-edge technologies across B2B, B2C, P2P, and B2G verticals. The firm’s groundbreaking innovations include AI-powered reconciliation software (ReckSoft.com) and advanced cloud accounting solutions (FinovatePro.com), setting new industry standards for efficiency, accuracy, and technological excellence.

JS Morlu LLC is a top-tier accounting firm based in Woodbridge, Virginia, with a team of highly experienced and qualified CPAs and business advisors. We are dedicated to providing comprehensive accounting, tax, and business advisory services to clients throughout the Washington, D.C. Metro Area and the surrounding regions. With over a decade of experience, we have cultivated a deep understanding of our clients’ needs and aspirations. We recognize that our clients seek more than just value-added accounting services; they seek a trusted partner who can guide them towards achieving their business goals and personal financial well-being.

Talk to us || What our clients says about us