If your Parent Teacher Organization (PTO) touches money — whether it’s from bake sales, spirit wear, or fun runs — here’s the uncomfortable truth: you’re running a business, whether you like it or not.

And just like any small business, your PTO can be audited, fined, embarrassed in public, or even dissolved if the financial books aren’t handled properly.

Too many PTO leaders think passion for the kids is enough to keep things safe. Unfortunately, the IRS, state regulators, and sometimes even fellow parents don’t share that view. That’s why it’s time to bust a few persistent money myths that keep PTOs in hot water — and learn the simple fixes that will keep your group thriving for years to come.

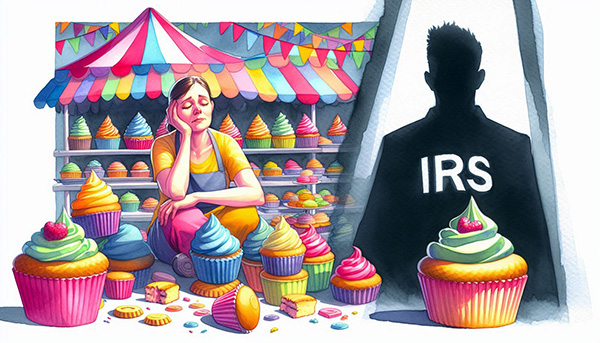

Myth #1: “We’re Just Volunteers — The IRS Won’t Care”

It’s a comforting thought, but completely false.

The IRS doesn’t care if you stayed up all night making cupcakes or running a carnival. If you file late, file incorrectly, or don’t file at all, your PTO can lose nonprofit status or face penalties big enough to erase a year’s worth of fundraising in one letter.

Think about it this way: if your group raises $15,000 for playground equipment and then loses $5,000 to penalties because of sloppy filings, how do you explain that to parents who trusted you with their money?

The Fix: Treat tax filings like a priority, not an afterthought. Even small PTOs benefit from professional tax guidance to make sure everything is compliant. It’s far cheaper than paying fines later.

Myth #2: “We Trust Everyone, So We Don’t Need Audits”

Trust is wonderful. Controls are better.

Every year, money disappears from PTOs. Sometimes it’s theft. More often, it’s simple mistakes: missing receipts, forgotten deposits, or fuzzy memory about who paid for what. These errors not only frustrate volunteers but can destroy trust with parents and teachers.

An annual financial review (or light audit) is like a seatbelt: you don’t skip it just because you’re a careful driver. It’s protection — for your volunteers, your reputation, and the future of your group.

The Fix: Schedule an independent financial review every year. It doesn’t have to be a full-blown audit; even a review by an outside accountant can give your group a clean bill of health and peace of mind.

At JS Morlu, we often work with nonprofits and community groups to design cost-effective financial reviews that catch problems early.

Myth #3: “Small PTOs Don’t Need Professional Help”

“We only raise $5,000 a year — the IRS won’t notice us.”

Wrong again. Smaller PTOs actually get into trouble faster because they think they’re “too small to notice.” But the truth is, small numbers are easier to misplace — and one missing deposit can feel catastrophic.

Even tiny organizations must follow basic rules: maintain nonprofit status, file required forms, and keep clear records. Skipping these steps is like saying, “My car is old, so I don’t need brakes.”

The Fix: Even small PTOs should use proper accounting tools (not a shoebox or spreadsheet) and set aside a little budget for professional guidance. Think of it as insurance against mistakes that could cost you far more.

The Big Fix: Treat Your PTO Like a Real Organization

So how do you prevent money headaches, protect your volunteers, and keep your group running smoothly? Start by treating your PTO like the real organization it is:

✅ Get professional assurance once a year. A quick check now saves a crisis later.

✅ Use proper accounting tools. Ditch the shoebox. Cloud-based accounting software makes life easier.

✅ Document everything. Who spent what, when, and why should always be written down.

✅ Train your leaders. Your treasurer and president are your CFO and CEO. Give them the tools and training they need.

💡 Fun Fact: The number one reason PTOs dissolve isn’t lack of volunteers — it’s messy money.

When financial processes are clear, transparent, and professionally reviewed, volunteers are happier, parents are more trusting, and the PTO can focus on what really matters: supporting students.

Why This Matters for More Than Just PTOs

While this article speaks directly to PTOs, the same lessons apply to nonprofits, HOAs, and small community organizations. These groups often run on goodwill and volunteer energy — but the financial rules are the same ones that apply to businesses.

Whether you’re managing homeowner dues, church tithes, or booster club funds, remember: regulators, donors, and members expect accountability. And if you don’t deliver it, the fallout can be devastating.

At JS Morlu, we specialize in helping nonprofits and small organizations avoid these pitfalls. From fund accounting to compliance audits to annual reviews, we provide the tools and expertise needed to keep community groups financially healthy.

Bottom Line

Being a PTO leader isn’t just about spirit wear, bake sales, and fun runs. It’s about being the guardian of every dollar parents trusted you with.

If you keep your books clean, your reporting clear, and your practices transparent, you’ll not only avoid IRS trouble but also build a stronger, longer-lasting PTO.

And when money is managed wisely, the rewards ripple far beyond the ledger — into classrooms, playgrounds, and the smiling faces of the kids you’re ultimately here to serve.

👉 Need Help? At JS Morlu, we help nonprofits and community groups set up strong, compliant financial systems that prevent costly mistakes. Whether you’re a PTO, HOA, or charitable foundation, our audit, tax, and advisory services can give you peace of mind and the freedom to focus on your mission.

📞 Contact us today to schedule a free consultation and keep your group’s finances strong.

JS Morlu LLC is a top-tier accounting firm based in Woodbridge, Virginia, with a team of highly experienced and qualified CPAs and business advisors. We are dedicated to providing comprehensive accounting, tax, and business advisory services to clients throughout the Washington, D.C. Metro Area and the surrounding regions. With over a decade of experience, we have cultivated a deep understanding of our clients’ needs and aspirations. We recognize that our clients seek more than just value-added accounting services; they seek a trusted partner who can guide them towards achieving their business goals and personal financial well-being.

Talk to us || What our clients says about us