Why borrowing money to build things that matter is smarter than pretending you can “bootstrap greatness” with vibes alone.

By: John S. Morlu II, CPA

Debt.

Just hearing the word makes some people twitch. Others start sweating like they just opened their bank app.

But here’s the truth nobody told you in school:

Debt isn’t the villain. Misusing it is.

Used properly, debt is a time machine. It lets countries and companies do big things now that will make even more money later. It’s like planting a mango tree with money you haven’t earned yet — and one day, you’re sitting under the shade, sipping juice, and hiring people to pick your fruit.

Let’s take a wild, witty, and wise ride through how countries and businesses use debt like pros — and how you can spot the difference between building wealth and building a financial dumpster fire.

1. Debt: The Gym Membership for National Growth

Imagine your country is out of shape — no roads, no power, no Wi-Fi, and the economy runs on goats and good intentions. What do smart governments do?

They borrow money. Lots of it.

But not to buy new government chairs or fund the president’s cousin’s birthday bash.

They borrow to build bridges, airports, fiber optic cables, water systems, and schools — the stuff that helps people actually make money and pay taxes later.

Fun Fact: The U.S. has over $34 trillion in debt, and it’s still printing dollars like it’s Monopoly night. Why? Because the U.S. invested that debt into things that produce value — highways, universities, Silicon Valley, and military bases the size of small countries.

Smart Country Example: After World War II, the U.S. launched the GI Bill, giving soldiers free college. They used debt to fund it. Those soldiers came home, got educated, bought homes, started businesses, and paid tons of taxes.

Result? The greatest economic boom in history.

2. Human Capital: Fancy Words for “Smarter People Make More Money”

Let’s keep it real: People are the real engine of any economy. You can have all the oil, gold, and cocoa beans in the world, but if nobody knows how to turn them into money, you’ll stay broke forever.

So when countries borrow to invest in education, healthcare, tech training, teacher salaries, or even school lunch, they’re not being soft. They’re investing in human capital — aka, people who can do things besides complain on Twitter.

Satirical Reality Check: Borrowing to build a stadium = claps and TikToks.

Borrowing to build 100 trade schools = actual national productivity.

True Story: South Korea went from war-torn rubble in the 1950s to a tech powerhouse.

How? They borrowed money to educate everyone — and now they make your TV, your phone, your car, and your favorite K-pop band.

3. Businesses Use Debt Like Jet Fuel (If They’re Smart)

Imagine a small business that refuses to borrow.

No loans. No credit. Just one tired founder, a dream, and exactly $47 in the account.

Sounds safe? Nope. Sounds slow, stressed, and soon-to-be shut down.

The world’s biggest companies LOVE debt — because it lets them move fast, scale hard, and make more money than they spend on interest.

Fun Fact: Apple has so much cash they could buy entire countries. But guess what? They still borrow money — because interest rates are cheap, and returns on iPhones are massive.

Legendary Example: Amazon.

- Founded in 1994, went public in 1997. Didn’t post an annual profit until 2003.

- That’s nearly 10 years of losses, while Jeff Bezos kept borrowing and reinvesting in warehouses, logistics, cloud infrastructure, and customer obsession.

- Today? Amazon is worth $1.9 trillion. AWS alone makes more than some countries.

4. Other Billion-Dollar Businesses That Borrowed Big

Tesla

- Nearly went bankrupt multiple times.

- Took a $465 million government loan + private loans + Elon Musk borrowing against his shares.

- Today? Tesla is a global electric vehicle juggernaut worth over $1 trillion.

Netflix

- Borrowed over $16 billion to create original shows.

- Everyone said it would fail. They were wrong. Netflix now has 230+ million subscribers and a market cap over $250 billion.

Uber

- Raised over $25 billion in VC and debt.

- Didn’t post a profit for over a decade. Now valued over $140 billion.

SpaceX

- Borrowed and raised billions to build reusable rockets.

- Now valued at $180 billion+ and dominates the space race.

Starbucks

- Borrowed to expand storefronts globally.

- Now in over 80 countries with 35,000+ stores and $35+ billion in annual revenue.

5. Power Debt vs. Dumb Debt: Know the Difference

Let’s play “Good Debt or Dumb Debt?”

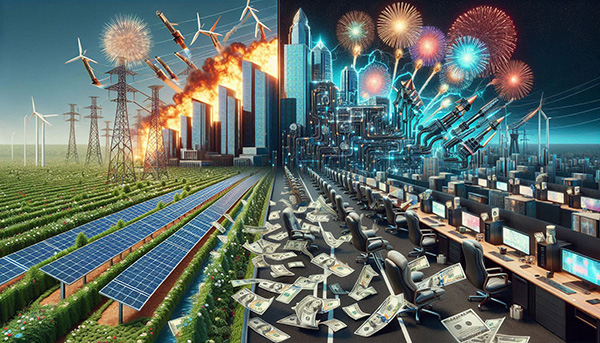

Borrowing to fund solar energy = Good Debt

Borrowing for VIP office chairs = Dumb Debt

Borrowing to digitize taxes = Good Debt

Borrowing to host a fireworks-filled summit = Dumb Debt

Simple Rule: If it grows income, it’s good. If it looks good but earns nothing, it’s dumb.

6. How Countries Pay Debt Back: With Their People

When countries invest in real things, the people pay back the debt:

- Through more jobs

- More businesses

- Higher income

- More taxes

Real Example: Singapore borrowed heavily in the 60s and 70s. Now? It’s a rich nation with no resources except smart people, excellent policies, and a port that prints money.

7. Poor Countries Should Borrow (Smartly)

The myth that poor countries shouldn’t borrow is dangerous. Without loans, they can’t build roads, power grids, or schools. And without that, they can’t ever stop being poor.

Fun Fact: China’s Belt and Road Initiative lent $1+ trillion to other countries to build infrastructure. Not charity. Strategy.

Satirical Truth: Telling a poor country not to borrow is like telling a hungry farmer not to buy seeds because “debt is scary.”

8. Final Wisdom: Debt is Fire. Cook with It, Don’t Burn Your House

Debt is a power tool. Like fire.

Use it to cook = delicious progress.

Use it to burn curtains = catastrophe.

Rule of Thumb:

- If it builds your future = borrow boldly.

- If it buys likes on Instagram = don’t.

Conclusion: Borrow Bold. Build Smart.

Debt isn’t evil. Fear of risk is.

The greatest companies and countries in the world don’t fear debt — they use it to fund the future.

So next time someone says, “debt is bad,” smile and ask:

“Bad for what? Building Gucci stores? Or building greatness?”

Because when used wisely, debt won’t destroy you — it’ll deliver you.

About the Author

John is an entrepreneur, strategist, and founder of JS Morlu, LLC, a Virginia based CPA firm with multiple software ventures including www.FinovatePro.com, www.Recksoft.com and www.Fixaars.com . With operations spanning multiple countries, John is on a mission to build global infrastructure that empowers small businesses, entrepreneurs, and professionals to thrive in an increasingly competitive world. He believes in hard truths, smart execution, and the relentless pursuit of excellence. When he’s not writing or building, he’s challenging someone to a productivity contest—or inventing software that automates it.

JS Morlu LLC is a top-tier accounting firm based in Woodbridge, Virginia, with a team of highly experienced and qualified CPAs and business advisors. We are dedicated to providing comprehensive accounting, tax, and business advisory services to clients throughout the Washington, D.C. Metro Area and the surrounding regions. With over a decade of experience, we have cultivated a deep understanding of our clients’ needs and aspirations. We recognize that our clients seek more than just value-added accounting services; they seek a trusted partner who can guide them towards achieving their business goals and personal financial well-being.

Talk to us || What our clients says about us