By: John S. Morlu II, CPA

As the great Ronald Reagan once said, “Trust, but verify.” A nugget of wisdom that resonates with every leader who has faced the unpredictable reality of managing people and business. It’s a simple principle that encapsulates the delicate balance between faith in human nature and the sobering need for accountability. Yet, in today’s hyper-competitive world, even that approach feels insufficient. Why? Because people, no matter how reliable they may seem, are inherently unpredictable. Employees, vendors, service providers, customers—each one is as fragile and changeable as a soufflé, easily deflated by the slightest shift in circumstances. One day, they’re the backbone of your operation, and the next, they’re calling in with the latest excuse or raising prices because of so-called “market conditions.”

The business landscape has evolved. Trust, once considered the bedrock of relationships, has become a double-edged sword. In a world where loyalty can be bought and sold, and professionalism can be swayed by personal whims, trust seems more like a liability than an asset. So, why do we still cling to the notion of trust in business? Why place the fate of your company in the hands of unpredictable human behavior?

Let’s dive deeper: why not eliminate the need for trust altogether? Imagine a world where trust is not only unnecessary but irrelevant. A system so efficient, so transparent, and so transactional that trust is rendered obsolete. Welcome to the age of the trustless system—a meticulously designed structure where everything is governed by processes, metrics, and accountability. This is business Nirvana. No emotional investments, no fragile dependencies on human loyalty—just cold, hard, transactional relationships that get the job done.

This isn’t a cynical take; it’s a strategic one. It’s about embracing the inevitable truth that people are unpredictable, but systems, when built right, are not. If you’ve ever been frustrated by an employee who unexpectedly quits, a vendor who fails to deliver, or a customer who switches allegiances over the slightest inconvenience, you’ll appreciate the power of a trustless system.

It’s time to reconsider the traditional assumptions of business relationships. What if the real key to success is not building trust, but building systems that make trust unnecessary? In the following chapters, we’ll explore how adopting a trustless system can revolutionize your approach to leadership, operations, and growth. Prepare to see the business world in a new light, where reliability is engineered, not hoped for, and where success is measured by systems that never let you down.

Got it! Let’s expand on all six chapters with greater detail, insights, and humor to create a comprehensive view of the “trustless” business world. Each chapter will be enriched with anecdotes, detailed examples, and humorous commentary to make it engaging and informative.

Chapter 1: Fickle Employees: The Unreliable Cog in Your Machine

Let’s start with employees. You hire them, train them, and invest time and energy into their professional growth, but what do they do? They call in sick on a Monday, leaving you staring at your email like it just insulted your mother. Your weekend peace is shattered by the thought of how you’ll cover their responsibilities. Or worse, they start shopping around for a better offer the minute they get a whiff of experience. Loyalty, thy name is LinkedIn notifications.

Even if you have the most loyal employee in the world—an absolute rock of stability—guess what? They’ll still leave one day, either for greener pastures or because they’ve decided to “take a gap year” to “find themselves.” This typically involves hiking through Peru or becoming an Instagram influencer selling ethically sourced, gluten-free, compostable, eco-friendly sunscreen. Either way, you’re left holding the bag.

Why Does This Happen? The job market has shifted dramatically. Where once loyalty was a badge of honor, now it’s as rare as finding a clean restroom at a gas station. Millennials and Gen Z workers are notorious for job-hopping—some studies suggest that the average employee will hold ten different jobs before the age of 40. That’s like dating ten people at once but only committing to the one who brings you free food.

The Employee Conundrum: You can have the most thorough interview process, but people can still be unpredictable. Remember that one star employee you thought you could count on? They’ve handed in their two-week notice to explore their passion for artisan bread-making. Who knew gluten could take precedence over a stable paycheck?

Solution? Enter the trustless system. Here, employees are simply replaceable parts in the great machine of business. Like a defective battery in a flashlight, if one goes out, you pop in a new one. Don’t bother with annual reviews or team-building exercises involving trust falls (because spoiler: they’re going to drop you). Instead, create roles so rigid and proceduralized that an octopus could do the job if you taught it to type.

Key Insight: To combat this unpredictability, businesses must focus on creating roles that are interchangeable. If one employee leaves, the remaining team should be able to absorb the work without skipping a beat. Think of it like a sports team; if your star player is out, you need solid bench strength to keep the game going.

Fun Fact: Did you know octopuses have three hearts? Clearly, they’re better at multitasking than your current receptionist.

Case Study: Consider Amazon, which has built a reputation for operational efficiency. They train employees to do multiple jobs, and when one leaves, there’s a process in place to quickly fill the gap. Their systems are designed to function with minimal reliance on individual employees.

Humorous Takeaway: Employees are like socks in the laundry—sometimes they disappear for no reason, and you’re left wondering if they ran off to join a sock rebellion.

Chapter 2: Vendors: The Delightfully Unreliable Partners

Now let’s talk about vendors—another delightful group of unreliable partners. One day, they’re giving you their best prices and delivering on time, and the next, they’ve hiked up their rates because “market conditions” or they’re out of stock due to “global supply chain issues.” Oh, please. If I wanted an economics lecture, I’d have paid more attention in college and not spent all my time at the campus pub.

The Vendor Shuffle: Here’s where a trustless system comes in handy. Rather than committing to any one vendor, you simply treat them as interchangeable players in your broader game of business chess. Every purchase, every order, every request for service is a new transaction. There’s no long-term commitment—just a series of short, cold, impersonal exchanges. If Vendor A raises prices, Vendor B is waiting in the wings. Vendor B drops the ball? Vendor C is eager to take over.

Why This Works: In a trustless system, you can negotiate without feeling obligated. It’s the kind of relationship where you can drop a vendor like a hot potato at the first sign of trouble. This keeps vendors on their toes, ensuring they know you have options. After all, if they think they can get away with overcharging or being unreliable, they’re in for a rude awakening.

Interesting Tidbit: A study found that 89% of vendors will change their prices if they think they can get away with it. The remaining 11% are busy making up new excuses for why your order is delayed.

Case Study: Look at any successful e-commerce platform—many rely on a network of vendors to source products. If one vendor can’t deliver, they simply pivot to another, ensuring their operations remain seamless. They thrive in a world where loyalty to vendors is as scarce as unicorns at a barbecue.

Humorous Takeaway: Working with vendors is like dating in the modern world. You swipe right on a good deal, but the moment they start ghosting you, it’s time to find someone new.

Chapter 3: Service Providers: The Ultimate Trust-Breakers

Then there are service providers—the lawyers, accountants, IT guys, and that quirky HR consultant who charges $500 an hour to tell you that you should “create a culture of feedback.” Right. Except when you give feedback, they look at you like you’re from Mars.

These folks operate in the ultimate realm of trust-based relationships. You’re paying them for their expertise, yet half the time they seem more interested in their golf game or planning their next vacation to the Maldives than actually providing service.

The Trust Dilemma: Here’s where the brilliance of a trustless system shines. Need legal advice? Pay by the minute. If your lawyer starts billing you for the time they spent Googling an answer, you’ve got a problem. In a trustless system, everything is scrutinized, metered, and verified. Your IT guy can’t “fix” your computer by turning it off and on again unless you see the time logged on an official report.

Why Trust is a Myth: The less you have to trust these service providers to do the job, the better. Make every interaction finite. Just like your love for that fleeting weeklong romance you had on a Caribbean cruise when you were 25, the relationship with your service providers doesn’t have to be everlasting.

Fun Fact: According to a recent survey, 57% of lawyers admitted to billing clients for tasks a paralegal could do faster. The other 43%? They are the paralegal.

Case Study: Companies like LegalZoom have disrupted the traditional legal landscape by offering services that allow clients to get legal help without the exorbitant fees of traditional firms. They put the power back into the hands of the client, making it easier to navigate legal processes without getting stuck in a web of billable hours.

Humorous Takeaway: Engaging a service provider is like getting a new haircut; you hope for a transformation, but you might end up with a disaster that leaves you questioning your life choices.

Chapter 4: Customers: The Goldfish in Your Business Aquarium

And now, the pièce de résistance: customers. Let’s cut to the chase: customers are like goldfish. No, not in the shiny, valuable way—more like in the “tiny attention span and easily replaceable” way. They’ll sing your praises one day and then switch to your competitor because they offered a free keychain with every purchase. Keychains, really?

The Customer Dynamic: That’s why, in a trustless system, customers are not kings—they’re pawns. You don’t invest in “building relationships” or “delighting them with surprise and joy.” No. You give them the product or service, they give you the money, and everyone moves on with their day. Sure, the transactional relationship may seem cold, but let’s be real: they don’t care. You could hand them a slightly warm cup of coffee, and they’d defect to the place next door that has iced lattes with biodegradable straws.

In this landscape, the concept of customer loyalty is as shaky as a tightrope walker in a windstorm. People often mistake a customer’s initial purchase as a vote of confidence, when in fact, it’s merely a momentary agreement to engage in a transaction. One wrong move—a price hike, a delay in service, or even a bad hair day for the barista—and they’re gone, leaving you staring at an empty chair and an untouched latte.

Fungibility in Action: In a hyper-transactional world, every customer is fungible, interchangeable, replaceable. Today’s loyal buyer is tomorrow’s Yelp reviewer claiming you “ruined their day” because you ran out of oat milk. Treat every customer like the fleeting engagement it is, and you’ll never be disappointed. The market is teeming with options, and customers are quick to explore them.

Imagine a busy coffee shop on a Monday morning. Customers shuffle in, eyes glued to their phones, ready to swipe left on any brand that fails to deliver a seamless experience. The barista’s mistake in calling out an order can lead to an impromptu social media storm. That single moment can transform a long-time patron into a disgruntled influencer ready to share their grievances with thousands.

Fun Fact: Did you know that on average, a person has an attention span of just 8 seconds? That’s less than a goldfish, which clocks in at 9 seconds. No wonder your customers can’t remember why they liked your product in the first place. This fleeting focus highlights the challenge businesses face in retaining attention in an age filled with distractions.

Case Study: Take a look at fast food chains that offer loyalty programs; they try to keep customers engaged with points and promotions, but the moment a competitor dangles a better offer, they’re out the door. One of the largest chains, for instance, launched an extensive app that allowed customers to accumulate points toward free food. However, when a rival introduced a limited-time menu item at a discounted price, those points lost their appeal. A marketing campaign that took months to build and roll out evaporated in the blink of an eye, reminding us that even the most robust loyalty strategies are no match for a better deal.

Additionally, consider the rise of food delivery services. While these platforms claim to foster customer loyalty through convenience, they often obscure the actual restaurant from the consumer. This disconnection means that if another restaurant offers a better price or faster delivery, the customer isn’t just willing but eager to switch their allegiance.

Humorous Takeaway: Customers are like the wind—sometimes they’re behind you, and other times, they’re slamming a door in your face because they found a better offer on Facebook. In the end, businesses must realize that maintaining relevance in a world where customers are essentially “one-click” away from a rival is no small feat. Adaptability, efficiency, and a keen understanding of customer behavior are crucial to thriving in this ephemeral marketplace. The goal? Make every second count, or risk becoming just another fish in a vast ocean of options.

Chapter 5: The Trustless Utopia: Where Transactions Reign Supreme

Welcome to the future of business—a world where trust is a relic of the past. In this utopia, everything is based on clear agreements, transparent transactions, and the understanding that everyone is out for their own best interest.

Why is this the future? As businesses face increasing competition and unpredictable market conditions, relying on trust is like betting your life savings on a game of poker with your brother-in-law—high risk, low reward. The new paradigm focuses on systems that enforce accountability, ensuring everyone knows their role and responsibilities.

The Paradigm Shift: Imagine a world where your suppliers, employees, and customers are all part of a finely-tuned machine. Everything operates seamlessly because there’s no ambiguity. If a vendor doesn’t deliver, there are consequences. If an employee fails to meet expectations, they’re quickly replaced.

Key Insight: The future of business will not be about relationships; it will be about transactions. Companies that thrive will be those that implement systems to enforce accountability without relying on interpersonal trust. Focus on efficiency and clarity in your operations.

Case Study: Companies like Tesla have mastered this approach. Their supply chain is built on the principle of accountability—if a supplier doesn’t meet standards, they’re out, plain and simple.

Humorous Takeaway: In a trustless utopia, business is like a well-oiled machine—efficient, predictable, and utterly devoid of any need for warm fuzzies or group hugs.

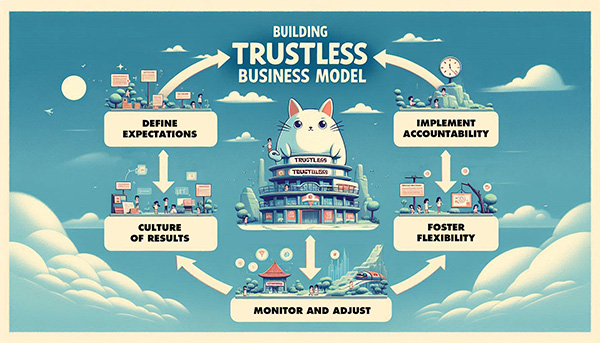

Chapter 6: Building the Trustless Business Model: A Roadmap to Success

Now that we’ve explored the components of a trustless business model, let’s break down how to build one from the ground up.

Step 1: Define Clear Expectations Every role, every vendor relationship, and every customer interaction should have clearly defined expectations. Create a handbook that outlines what success looks like and what happens when it’s not met. Think of it as a rulebook for a game that everyone needs to follow.

Step 2: Implement Accountability Systems Use technology to track performance and enforce accountability. This could mean automated reports, KPI dashboards, and regular check-ins that keep everyone in line.

Step 3: Cultivate a Culture of Results Encourage a results-driven environment where the focus is on outcomes rather than activities. Employees should know that their value is tied to their performance, not their personality.

Step 4: Foster Flexibility Design your business to be adaptable. This means having backup vendors, cross-training employees, and always being on the lookout for better solutions. A flexible organization can pivot when the unexpected occurs, rather than crumbling under pressure.

Step 5: Monitor and Adjust Constantly review processes and outcomes. If something isn’t working, change it. If a vendor is failing to deliver, switch them out. Keep your business lean, mean, and ready to roll with the punches.

Humorous Takeaway: Building a trustless business model is like training a dog—be firm, be clear about the rules, and don’t let them get away with any funny business. Otherwise, you might end up with a furry friend who thinks chewing your shoes is perfectly acceptable behavior!

Author: John S. Morlu II, CPA is the CEO and Chief Strategist of JS Morlu, leads a globally recognized public accounting and management consultancy firm. Under his visionary leadership, JS Morlu has become a pioneer in developing cutting-edge technologies across B2B, B2C, P2P, and B2G verticals. The firm’s groundbreaking innovations include AI-powered reconciliation software (ReckSoft.com) and advanced cloud accounting solutions (FinovatePro.com), setting new industry standards for efficiency, accuracy, and technological excellence.

JS Morlu LLC is a top-tier accounting firm based in Woodbridge, Virginia, with a team of highly experienced and qualified CPAs and business advisors. We are dedicated to providing comprehensive accounting, tax, and business advisory services to clients throughout the Washington, D.C. Metro Area and the surrounding regions. With over a decade of experience, we have cultivated a deep understanding of our clients’ needs and aspirations. We recognize that our clients seek more than just value-added accounting services; they seek a trusted partner who can guide them towards achieving their business goals and personal financial well-being.

Talk to us || What our clients says about us