By: John S. Morlu II, CPA

In today’s fast-paced and high-stakes startup ecosystem, failure has undergone a remarkable transformation. Once viewed as the ultimate business nightmare, failure has now become a badge of honor, a quirky rite of passage that aspiring entrepreneurs proudly wear. In boardrooms and investor meetings, failure isn’t just tolerated—it’s celebrated.

Picture this: at Google Ventures, a hub of innovation and risk-taking, startup founders don’t shy away from recounting their laundry list of missteps. They stand tall, shoulders back, and with an air of accomplishment, declare how they’ve burned through millions of dollars with little more than lessons learned to show for it. “I’ve blown three million dollars in just 18 months,” one entrepreneur might proclaim, their face lit with the same pride as someone who just announced a billion-dollar exit. Another beams, “I launched an app that crashed the servers on day one, and we never got it back up. Oh, and I’ve pivoted five times this year alone!”

The crowd, far from gasping in disbelief, erupts into applause. It’s no longer about the product or the service, but about the resilience, the audacity, and, perhaps most perplexingly, the loss of capital as some twisted marker of innovation. Sounds absurd, doesn’t it? And yet, this surreal scene is all too real. We now live in a world where failure, once the feared enemy of any business leader, has morphed into a peculiar badge of success.

It’s no longer enough to have a great idea—now, it’s about how dramatically you can fail while keeping a straight face and convincing investors to give you more money. But before we start questioning our collective sanity, let’s take a closer look at why spectacular, burn-it-to-the-ground failure is now something entrepreneurs boast about. What has happened to the business world that losing vast sums of money and crashing ventures are celebrated as stepping stones to success? Let’s explore.

Chapter 1: The Rise of “Fail Fast, Fail Often”

Let’s start by pulling back the curtain on one of the most beloved mantras in the startup world: “Fail fast, fail often.” For the uninitiated, it sounds deep and philosophical—like something a Silicon Valley monk would say before dropping his macchiato and running off to another pitch meeting. But if you’ve been in the startup game for any length of time, you’ll know this is less about enlightenment and more about failing while holding someone else’s checkbook.

The concept is this: failure teaches you things success never could. And while that’s undoubtedly true, the startup culture has taken it to a whole new level. Entrepreneurs are almost encouraged to fail—not just once or twice, but repeatedly. It’s like failure is your membership card to the exclusive “I Failed So Hard, I Succeeded” club. A place where founders boast about their long list of spectacular failures like battle scars, proud of how much venture capital they burned through.

It’s not uncommon to hear conversations like:

- “My first startup crashed in a year.”

- “That’s nothing. I tanked three in six months! Raised $20 million and spent it all on a hologram that projected motivational quotes from Elon Musk.”

Instead of seeing failure as a roadblock, entrepreneurs treat it as the equivalent of leveling up in a video game. If you’re not careening toward bankruptcy at least twice a year, are you really an entrepreneur?

But here’s the thing: While the “fail fast” philosophy encourages iteration and learning, somewhere along the line, it morphed into an excuse to throw caution (and financial responsibility) to the wind. Common sense took a back seat. Now, instead of mitigating risks, many startups embrace them with reckless abandon. Because, hey—if you’re not losing money, are you even innovating?

Chapter 2: Losing Money: The New Business Model

In the old days (think your granddad’s time), businesses were judged on something as mundane as profit. Yes, that boring old metric where you had to make more money than you spent. Today? Making money is kind of…optional.

Look at Amazon—the poster child for losing money with style. For years, it was a financial black hole. But Jeff Bezos, with his Cheshire grin, kept saying, “Trust me, it’s all part of the plan.” And now? Well, he’s so rich he could probably buy your hometown, pave it with gold, and still have enough left over to start a colony on Mars. His genius? Convincing investors that long-term vision was more important than short-term profits.

Inspired by Bezos, a generation of startup founders decided that losing money was the ultimate mark of innovation. It became a strategy: “If Amazon can do it, why not us?” Instead of worrying about profitability, startups shifted their focus to growth—endless growth, even if it meant they were growing into a bigger and more spectacular failure.

Burn rate became the new buzzword. In investor meetings, founders proudly announced how quickly they were burning through cash, as if that alone was an indicator of success. They’d give presentations like, “We lost $5 million in our first year alone!” and wait for the standing ovation.

The strategy works like this: raise enough money to scale quickly, grab a significant chunk of the market, and then worry about making a profit…someday. If that doesn’t work, no problem—just pivot (we’ll get to that in Chapter 4).

In fact, some entrepreneurs seem to actively avoid making a profit too early. Profit? That’s so old school. It’s practically a dirty word. If you start making money right out of the gate, investors might accuse you of lacking vision or ambition. “Where’s the moonshot idea?” they’ll ask. “Why are you making money like some kind of ordinary business?”

Chapter 3: VC Logic: Betting on Failures

Now, let’s talk about venture capitalists—those shadowy figures in Silicon Valley who control the purse strings. From the outside looking in, you might think VCs have lost their marbles, constantly betting on founders who’ve crashed and burned multiple times. But this is all part of their grand strategy. VCs are like gamblers who, after losing hand after hand, remain convinced that the next bet will be the jackpot.

The logic works like this: they invest in ten startups, knowing full well that nine of them will fail miserably. But they’re not bothered, because that one success—the unicorn—will more than make up for the losses. And if you’ve failed a few times? Even better! That means you’re “experienced.”

In the world of VC, failure is sexy. Inexperienced founders with a trail of failed startups are seen as risk-takers, bold visionaries who’ve learned valuable lessons from their failures. They’re scarred, but in a good way—like a hero returning from battle. When these founders waltz into pitch meetings, VCs aren’t rolling their eyes at their failed pasts. They’re leaning in—fascinated by the narrative.

VCs love a good story, and there’s no better story than a founder who’s been knocked down multiple times but keeps getting up. After all, nothing says “resilient entrepreneur” like having gone bankrupt twice and still convincing people to give you millions for your next “big idea.”

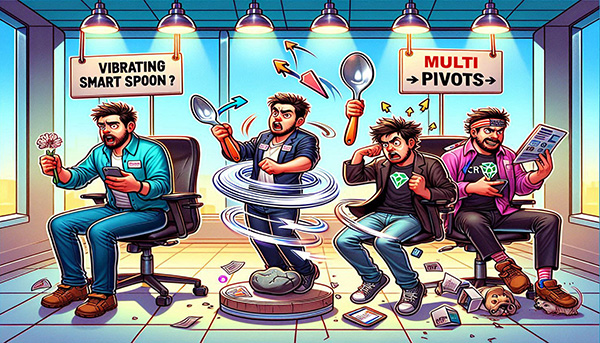

Chapter 4: Meet the Serial Failures

And now we meet the true stars of the startup world—the serial failures. These are the entrepreneurs who’ve turned losing money into an art form. But don’t get it twisted—they’re not losers. Oh no. They’re bold, disruptive geniuses (or at least that’s what their press releases say). Let’s look at a few typical profiles:

1. The Visionary Who Misses the Market: This entrepreneur comes up with an idea so wild, so mind-bogglingly irrelevant, that nobody ever asked for it. Think of the guy who developed a $199 smart spoon that vibrates with motivational quotes as you eat. Sure, nobody wanted it, but that didn’t stop him from raising millions in seed funding. And when the spoon flopped, did he give up? Of course not! He pivoted to an even stranger idea: a smart toothbrush that connects to your phone and tells you if you’re brushing with “optimal enthusiasm.”

2. The “Pivot” Addict: You know this one. They’ve never met a business model they didn’t want to change. They start with a brilliant app that delivers gourmet sandwiches to your office. Six months later, they’ve “pivoted” to a blockchain-powered platform for sharing leftover food with pigeons. When that fails (shockingly), they pivot again—to an AI-driven lawn-mowing service for hedgehogs. They’ve pivoted so many times they’ve spun themselves into a black hole of irrelevance, but guess what? Investors love it. They’re obsessed with the idea that the next pivot will be the one.

3. The Crypto Crusader: Armed with buzzwords like “decentralization” and “blockchain,” this entrepreneur wades into the crypto space, despite having no idea what they’re actually talking about. They launch an NFT marketplace for pet rocks, only to watch it crash and burn as quickly as it launched. But failure doesn’t slow them down. Their next pitch? A quantum-computing-based crypto exchange for AI pets in the metaverse. It makes no sense to anyone, but investors are throwing money at them because, well, blockchain.

Chapter 5: Common Sense: The Forgotten Hero

Let’s dial things back to reality for a moment. In the real world—where common sense still matters—failure is not a badge of honor. It’s something most people try to avoid.

Ask any small business owner who’s been hustling for years. To them, losing money is terrifying, not trendy. They aren’t out here trying to burn through capital as fast as they can—they’re trying to make payroll. While Silicon Valley might glamorize failure, your average small business owner lives by a simpler philosophy: “don’t go broke.”

However, while Silicon Valley’s fascination with failure continues to grow, there’s a quiet movement of entrepreneurs who still believe in the old-fashioned notion of building businesses that make money—responsibly. These entrepreneurs don’t care about being the next big unicorn. They’re not here to disrupt entire industries. They’re focused on things like profit margins, customer satisfaction, and sustainability.

Sure! Let’s give Chapter 6 an even deeper and more impactful insight, focusing on the fine line between productive failure and reckless failure, ending with an inspiring message for entrepreneurs.

Chapter 6: The Punchline: Learning to Fail—Responsibly

After all this talk about failure, here’s the real punchline: failure isn’t inherently bad. In fact, it’s inevitable. If you’re trying to create something new, something disruptive, something that the world has never seen before, failure is part of the process. It’s a necessary step toward innovation. The problem arises when we start to romanticize failure—when we treat it like a medal of honor without considering the lessons it’s supposed to teach.

Failure without learning is just failure. Period. In the startup ecosystem, too often we see founders boasting about how much they’ve lost, how spectacularly they’ve failed, without taking responsibility for what went wrong. But here’s the real truth: failing is not the goal—learning and adapting from that failure is.

Think of failure as a tool, not a destination. It’s meant to sharpen your vision, refine your strategy, and reveal weaknesses that you need to fix. If you fail the same way twice, you’re not learning—you’re repeating mistakes. And here’s the thing: real growth comes from using failure to adjust your course and create something better than you originally planned.

But there’s a crucial caveat: fail responsibly.

What Does It Mean to Fail Responsibly?

Failing responsibly means knowing where the limits are. It means understanding that the goal of failure is to learn, not to glorify the crash and burn. It means asking the hard questions like, “How do we recover?” and “What will we do differently next time?” It’s about having a clear sense of accountability to your investors, your employees, and—most importantly—yourself.

Signs You’re Failing Responsibly:

1. You have a clear post-mortem process: Every time something doesn’t work, you sit down with your team and analyze it. What went wrong? Why did it happen? How can we prevent this in the future? It’s a conversation rooted in finding solutions, not placing blame or celebrating the magnitude of the failure.

2. You know when to pivot and when to double down: Failing responsibly means you don’t chase bad ideas forever. You know when a concept has hit its limit, and you have the courage to pivot or move on. Conversely, you also recognize when something’s worth fighting for, even if it’s currently stumbling.

3. You balance risk with rationality: Innovation requires risk, but not all risks are created equal. Failing responsibly means taking calculated risks, ones where you’ve weighed the potential downside. You don’t gamble everything on a long shot without considering the consequences.

4. You prioritize your team and customers: One of the biggest red flags that you’re failing irresponsibly is when your decisions put your team, your employees, or your customers in jeopardy. When the obsession with “failing fast” leads to broken promises to those who depend on you, that’s a sign you’ve lost your way.

5. You still have a clear path to profitability: Let’s not forget, the whole point of starting a business is to build something that creates value and eventually makes money. Failing responsibly means you’ve kept your eye on the long-term goal. You might be losing money today, but you still have a viable plan for how to become profitable down the line.

Failure Is Part of the Journey, Not the Destination

So, how do you balance the “fail fast” mentality with the need for responsibility and sustainability? It comes down to focus. It’s easy to get swept up in the startup culture of growth at all costs, but the truth is, you’re not here to fail. You’re here to succeed. And while failure can be an important stepping stone on the path to success, it’s still just that—a stepping stone, not the finish line.

The most successful entrepreneurs—people like Steve Jobs, Oprah Winfrey, or Elon Musk—have all failed spectacularly at some point in their careers. But what set them apart wasn’t the failure itself—it was how they responded to it. They learned from their failures, adapted their strategies, and kept moving forward. For them, failure was just another step in the iterative process of getting better.

Creating Value in the Real World

Let’s bring it all back to reality for a second. You’re not just building a business to raise rounds of funding, get a shiny office, and be the next big name on TechCrunch. You’re building a business to create value. That means providing something meaningful to your customers, making life easier, better, or more efficient for them in some way. And yes, that means eventually making money—because, without revenue, your business isn’t sustainable, and without sustainability, all those lofty ideas will crumble.

When you fail responsibly, you focus on this bigger picture. Each failure becomes a way to get closer to your real goal: building something that lasts.

Ask the Right Questions

So the next time you hear a founder bragging about how many millions they’ve lost, resist the temptation to nod along. Smile and ask them the real question: “When do you plan on succeeding?”

Because in the end, that’s the only metric that really matters. Not how many times you failed, but how you turned those failures into lessons that propelled you to eventual success. Success isn’t just about launching the next unicorn—it’s about creating something that matters, something that works, and something that lasts.

And isn’t that what entrepreneurship is really about? Solving problems, creating value, and making a meaningful impact on the world. Failing might be part of the journey, but it’s the success at the end that makes it all worth it.

So, go ahead and embrace the failures, but remember: fail fast, learn faster, and—most importantly—succeed responsibly.

Because in the end, that’s what matters most.

Author: John S. Morlu II, CPA is the CEO and Chief Strategist of JS Morlu, leads a globally recognized public accounting and management consultancy firm. Under his visionary leadership, JS Morlu has become a pioneer in developing cutting-edge technologies across B2B, B2C, P2P, and B2G verticals. The firm’s groundbreaking innovations include AI-powered reconciliation software (ReckSoft.com) and advanced cloud accounting solutions (FinovatePro.com), setting new industry standards for efficiency, accuracy, and technological excellence.

JS Morlu LLC is a top-tier accounting firm based in Woodbridge, Virginia, with a team of highly experienced and qualified CPAs and business advisors. We are dedicated to providing comprehensive accounting, tax, and business advisory services to clients throughout the Washington, D.C. Metro Area and the surrounding regions. With over a decade of experience, we have cultivated a deep understanding of our clients’ needs and aspirations. We recognize that our clients seek more than just value-added accounting services; they seek a trusted partner who can guide them towards achieving their business goals and personal financial well-being.

Talk to us || What our clients says about us